• Do you want to sell your company?

• Want to buy a company or business?

• Do you want to find a partner to expand your business in partnership?

• Do you want to manage your real estate assets through a fund?

How much does it worth a company, a participation in a company or in a group of companies? This is certainly a question for which you have no answer and which will certainly be useful to you at some point in your business life.

The possibility of selling your business or your participation must be sustained in a correct assessment of company value.

With this in mind, Causa & Feito responds to this type of needs, advising client companies in the elaboration of growth strategies through mergers and acquisitions – seeking to identify the best financing solutions for them.

We emphasize that a professional analysis can reveal a company value substantially different from the one initially considered.

This service main goals are fundamentally the following:

CORPORATE FINANCE

Causa & Feito offers its clients solutions in the area of corporate finance working in partnership with private equity funds, venture capital companies, investment banking and business angel networks, meeting the criteria and specifications of each transaction.

The constant economic and markets mutations, the highly competitive environment; the unfavorable or pressing conjuncture and the difficulty of access to financing sources, pose additional challenges to companies.

The permanent adaptation of companies growth strategies and the access to alternative sources of financing are tactical options and critical factors to achieve a company favorable and challenging positioning.

With this in mind, Causa & Feito responds to this type of needs, advising client companies in the elaboration of growth strategies through mergers and acquisitions – seeking to identify the best financing solutions for them.

Various types of transactions can be structured considering the specific characteristics of the company and its shareholders.

MBO (Management Buyout) | Acquisition (buyout) of company control by the respective management team or by its minority partners, using financing through the entry of financial partners. |

MBI (Management Buyin) | Acquisition of company control by external management team, using financing through the entry of financial partners. |

BIMBO (Buyin Management Buyout) | Combination betweeen MBO and MBI |

OBO (Owners Buyout) | Buyout in which some of the company’s controlling shareholders acquire one area of the business or the company itself to the other shareholders, strengthening their position and being supported by financial partners. |

LBO (Leverage Buyout) | Acquisition of a company, financed with a high debt component |

| Capital Fundraising | Start-Up: Funding for product development or marketing strategy. Early – Stage: Financing for company development at the beginning of the life cycle, and that have not yet reached breakeven. Expansion: It aims to assist growth of an already established company. It could materialize in internationalization, increase in production capacity or in the development of a new product or service. |

| IPO and Private Placement | Raising capital to finance the growth strategy either through a public placement (IPO) or a private placement in the Alternext market, stock exchange managed by Euronext (a subsidiary of NYSE Euronext). This type of operation has implicit a set of advantages for the admitted companies of which stands out: – Obtaining Financing Via a Capital Increase |

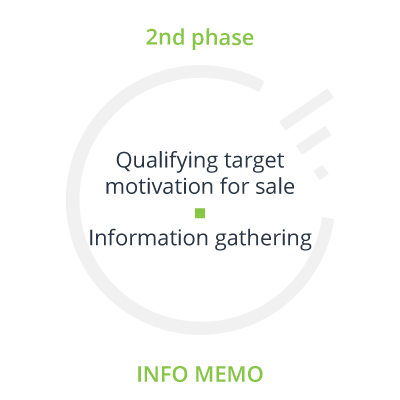

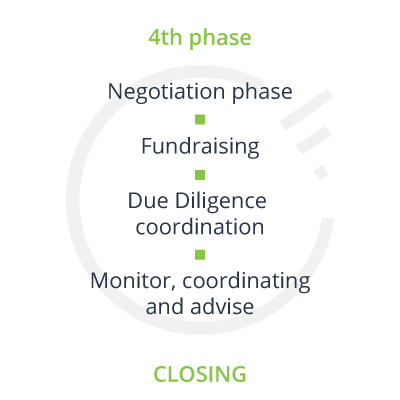

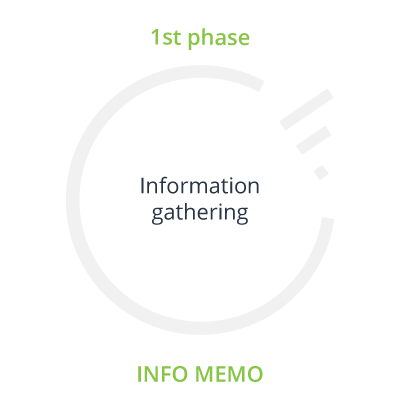

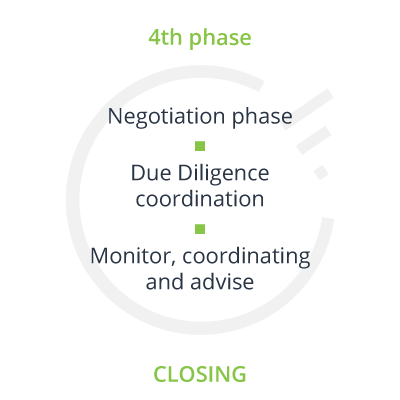

Causa & Feito work plan follows a successful methodology, which goes through the analysis of the company’s reality and definition of the strategy, the basis for the development of a structured business plan and subsequent presentation to potential investors.

Causa & Feito accompanies the whole negotiation process, supporting the company through all process phases.

Industry company specialized in plastic injection molds, focused on the automotive industry. 100% export company. 20 workers Operating in new facilities with capacity to be expanded.

Annual Sales: 750.000€

EBITDA: 100.000€

Country: Portugal

Dairy industry in the central coast, specializing in the production of Flemish cheese. With all the necessary authorizations for the respective work.

Annual Sales: N/D

EBITDA: N/D

Country: Portugal

Industry company specialized in plastic injection molds for the automotive and utilities industries. Company with great technical and technological capacity. Exports over 75% of production. FTE of about 50 workers. Operates on recent facilities.

Annual Sales: 2.500.000€

EBITDA: 250.000€

Country: Portugal